This is the second blog in a series of three about SAP Group Reporting. If you have not yet done so, please read the first blog in the series, An Introduction To Group Reporting.

This is the second blog in a series of three about SAP Group Reporting. If you have not yet done so, please read the first blog in the series, An Introduction To Group Reporting.

This blog will cover the summary of the main tables, customizable objects, and master data elements used in the consolidation processes within SAP Group reporting.

Data Model

Source Tables: The tables used to obtain the financial records for entities in SAP S/4HANA are:

- Table ACDOCA: Universal Journal Entry Table. It contains the actual postings that will be transferred to the consolidation table.

- Table ACDOCP: Plan Data Line Items. It contains the plan postings that will be transferred to the consolidation table.

Group Reporting Tables: The tables used to maintain the Group reporting processes are:

- Table ACDOCU: Universal Consolidation Journal Entries. It incorporates the consolidation records transferred from S/4HANA finance tables, collected from API, or processed by manual postings.

This table has over a hundred fields, the most important being: consolidation ledger, financial statement item, consolidation unit, transaction currency, local currency, and group currency. The data is stored on a periodic basis.

- Tables FINCS: Configuration and Mapping Tables specific for Group Reporting. In S/4HANA 1909 there are over 70 tables available.

Customizable Objects

This section details the elements that are required to configure in the system through Customizing (Transaction Code SPRO) to run Group reporting processes. The screenshots are based in SAP S/4HANA 1909 release.

Consolidation Ledger: This element is defined by two main attributes:

- Group currency: Determines the currency of the financial data of the consolidation groups. To consolidate in different currencies, it is required to create separate ledgers for each group currency.

- Valuation related to a reference ledger: The reference ledger specifies the source ledger of the universal journal on the FI accounting side. The integrated values are taken from the reference ledger.

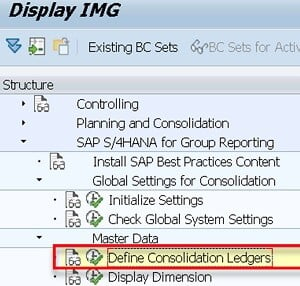

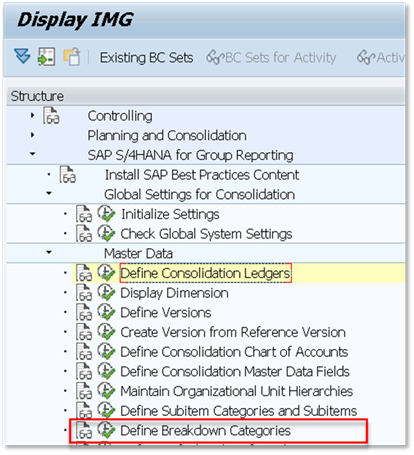

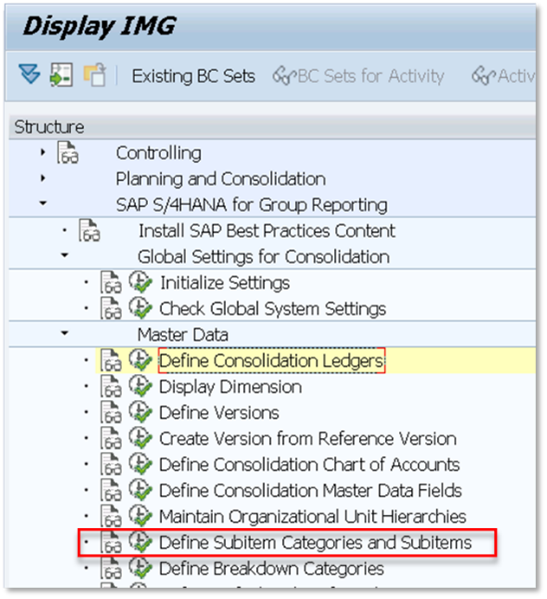

To define a consolidation ledger the following IMG path is accessed:

SAP delivers ledgers Y1 with the currency EUR and Y2 with the currency USD.

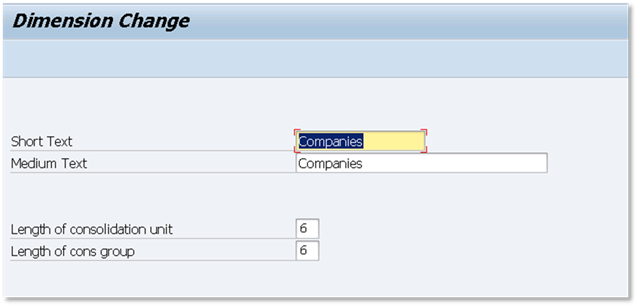

Consolidation Dimension: Organizational unit to proceed with consolidation. To define or edit a consolidation dimension the following IMG path is accessed:

By default, SAP delivers Y1 - Companies.

The default and minimum length of consolidation unit is 6, to consider external companies not included in SAP S/4HANA.

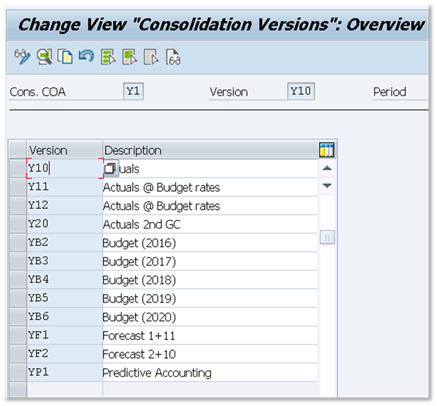

Consolidation Version: Identifies a specific data area in the consolidation database to fulfill different reporting needs. For example to separate actuals data for publishing official reports from planning and forecast data for internal evaluation.

To define a consolidation version the following IMG path is accessed:

SAP delivers several consolidation versions that can be adjusted or added to new ones.

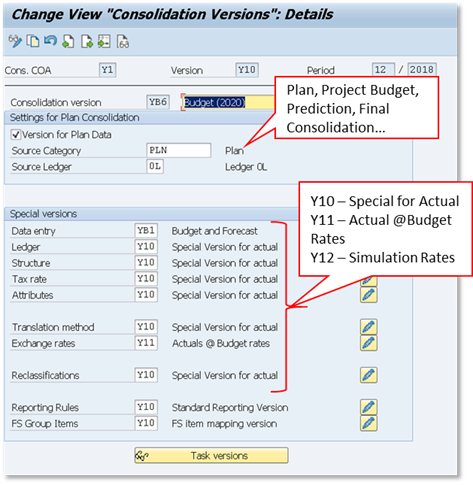

It is possible to assign special versions to retrieve the maintained settings among different consolidation versions. Then, it is only needed to enter the control parameters once in special versions and assign the special versions to consolidation versions.

For example, consolidation versions for actuals data and planning data can share all special version settings except that for Data entry. In this case, you can assign different Data entry special versions but the same other special versions to each consolidation version. When you perform a task in a consolidation version, the system reads the special versions that are relevant for that task and that are assigned to that consolidation version.

Find below a sample configuration for Budget Version for a given year:

Find also below the configuration for the actual Version:

Breakdown Category: Classifies sub-assignments that are required for Financial Statement (FS) items to perform consolidation tasks. The following breakdown category fields are supported:

- Partner Unit

- Subitem Category

- Subitem

- Transaction Currency

- Unit of Measure

For each FS item, the breakdown category determines which sub-assignments must be maintained.

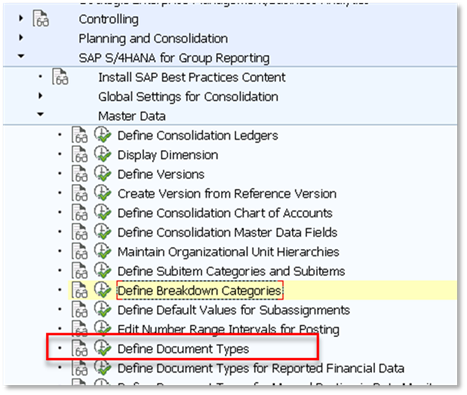

To define a breakdown category the following IMG path is accessed:

SAP delivers several breakdown categories that can be adjusted or added to new ones.

.jpg)

.jpg)

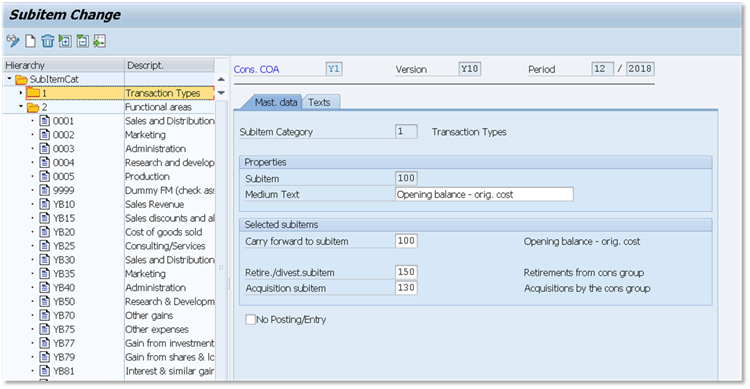

Subitem Category: Classifies the subitems, which are needed for the sub-assignment of Financial Statement items. A subitem category is assigned to the relevant FS items via breakdown categories.

SAP delivers two predefined subitem categories: Transaction Types and Functional areas.

To define a subitem category or subitem the following IMG path is accessed:

Each subitem category contains the possible subitems to be determined with the description of each of them. Subitems are used to further breakdown the values recorded on financial statement (FS) items. For example, transaction type 100 (opening balance – Orig. cost) is used for balance carryforward.

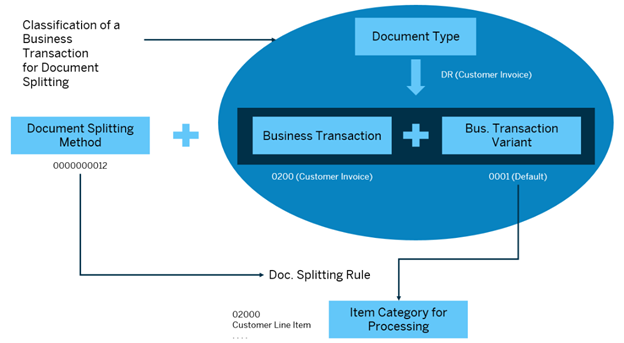

Document Type: Identifies the type and source of data; i.e., reported data is stored on different document types than elimination data. Can be used in various consolidation settings, tasks, and reports.

To define a document type the following IMG path is accessed:

Document types have various attributes assigned, including data sources (manual or automatic posting, file upload, or API), posting levels, deferred income tax handling, automatic reversal, and currencies to be used in posting.

.jpg)

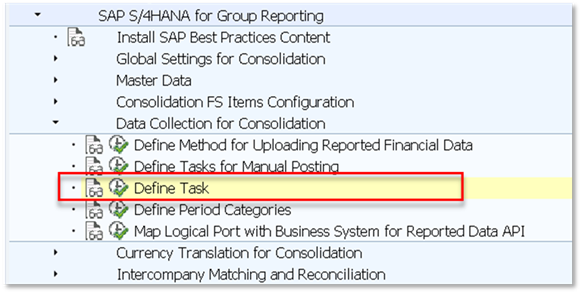

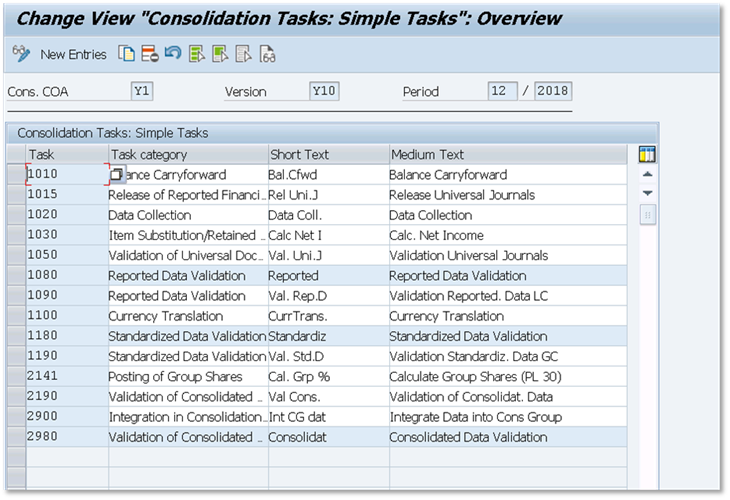

Task: Activities for collecting and preparing the financial data reported by the consolidation units in consolidation processes.

To define a task the following IMG path is accessed:

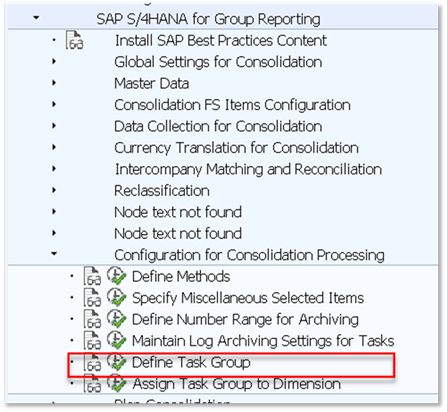

Task Group: Define the tasks included in the Data Monitor and Consolidation Monitor, ensuring a logical sequence and consistent data.

To define a task group the following IMG path is accessed:

.jpg)

The position assigned to the task represents the order in which the task will be displayed in the Monitor.

.jpg)

Master Data Objects

This section details the master data elements that are maintained by the users to run Group reporting processes. The screenshots are based in SAP S/4HANA 1909 release.

Financial Statement Item: Represents the fundamental account assignment in the consolidation system.

FS items are dependent on the consolidation chart of accounts. They are not only used for accounting purposes on balance sheets, P&L statements, or statements of retained earnings but can also be used for maintaining metrics and key figures.

SAP pre-delivers a set of FS items, that can be edited or extended using the following Fiori App in the Launchpad:

This Fiori App has the capabilities to display the existing Financial Statement Items considering the selections done in the filter area. From the list, it is possible to edit the selected FS item or create a new one.

.jpg)

The main characteristics to maintain are:

- FS Type: Attribute that indicates the nature of FS items.

- Breakdown Category: Mandatory or optional assignments to be determined while posting with the FS item.

- Selection Attributes: Classification assigned to FS items so that all FS items that share the same attribute value can be selected in order to be treated in the same way, for example, in consolidation tasks.

Target Attributes: Designed to derive an FS item based on another FS item for specific purposes. If you use target attributes, you don't have to assign the FS items in the rule itself. Instead, the system identifies FS items based on the master data. For example, for the FS item 111100-Cash on hand, you select the FS item 111200-Short term deposits for the elimination target attribute.

.jpg)

The GL accounts relevant for consolidation purposes are required to be mapped with an FS item. The maintenance of that mapping is done acceding to the following Fiori App in the Launchpad:

This Fiori App has the capabilities to create a new mapping, edit/display the existing mapping or import the mapping from a template.

.jpg)

In case of importing the FS Item mapping, the system will show a pop-up to choose the file to upload it. On the same screen, there is the option to download the template to make sure the file is correctly populated.

.jpg)

In case of editing or displaying the mapping, the system will display all the GL accounts already mapped with an FS item and the GL accounts pending to map to be reviewed.

.jpg)

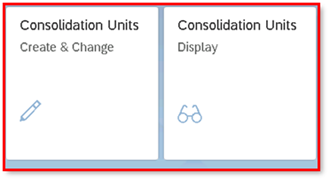

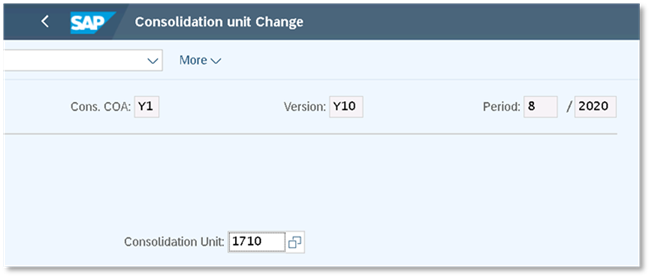

Consolidation Unit: Lowest organization level for consolidation.

The consolidation units can be created, edited, or display using the following Fiori Apps in the Launchpad:

The following settings will be defined for each consolidation unit:

- Tax Rate: Default tax rate applicable in postings.

- Local Currency

- Translation Method: determines the exchange rate used for specific financial statement (FS) items to translate the local currency to the group currency, and how translation and rounding differences are posted.

- Data Transfer Method: Specifies how the local reported financial data is collected for consolidation. Having the option to choose one of the following methods:

- Read from Universal Document: applicable for consolidation units whose reported financial data is handled in the S/4HANA system.

- Flexible Upload

Consolidation Group: Structured list of consolidation units. A consolidation unit can belong to one or more consolidation groups.

The consolidation groups can be created, edited, or display using the following Fiori Apps in the Launchpad:

The following settings will be defined for each consolidation group:

- Ledger: Consolidation Ledger using for processing the consolidation unit.

- Group Currency: Determined by the consolidation ledger.

- Method: Validation methods assigned to the consolidation group.

Once the consolidation groups are defined, the consolidation units are assigned to them using the following Fiori Apps in the Launchpad:

While assigning the consolidation unit, is required to define the type of consolidation method that will be used and the periods of assignment to the consolidation group.

.jpg)

Validation Rule: Condition to verify data correctness according to basic financial principles, such as total assets must equal the sum of the total liabilities plus the sum of total equity.

The defined validation rules can be used to verify reported data, standardized data, and consolidated data along the consolidation process. They are defined using the following Fiori App in the Launchpad:

While defining rules, the following parameters are maintained:

- Rule expression: Comprised of two formulas and a comparison operator. A formula can include fixed amounts, constants, mathematical operators, and year-to-date amounts posted with a range of FS items.

- Tolerance settings: Tolerance value or tolerance percentage, so that the difference between the calculated values between both formulas can be ignored as long as it does not exceed the tolerance.

- Control level Specifies how strict the rule is. That means if a failed validation results in an error, warning, or information status for the respective validation task in monitors.

- Group-by field: Specifies the grouping criteria of the data validated by the rule in the way that will be organized on the validation result screen.

- Comments required: Select the checkbox if comments are needed to provide further explanation for the validation result.

.png)

Validation Method: Set of validation rules to verify data correctness.

The validation methods can be created and assign to them multiple defined rules using the following Fiori App in the Launchpad:

SAP pre-delivers the validation methods SRD1 (Local Data Validation Method) and SCD1 (Consolidated Data Validation Method) that contain a set of predefined rules. It is possible to create new methods in the customer namespace: IDs not starting with the prefix S.

Once the validation methods are defined, they can be assigned to consolidation groups or consolidation units depending on the task selected: reported data validation, standardized data validation, or consolidated data validation. The assignment is done in the following Fiori App:

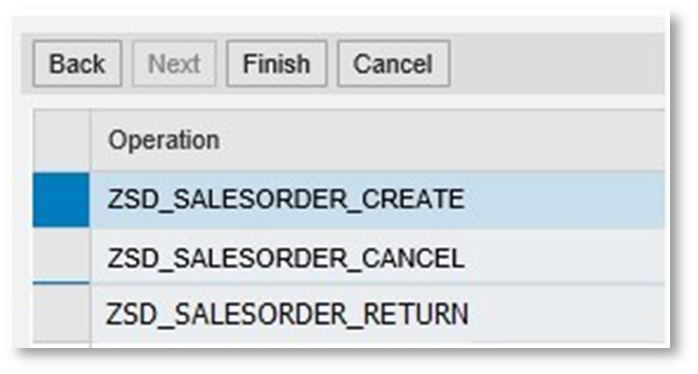

First, the desired task will be selected:

For the 01 and 02 task types, the validation method is assigned to consolidation units, while for the 03 task type, the validation method is assigned to consolidation groups.

In the assignment screen, the validation method is activated for the desired periods and consolidations units/groups.

.jpg)

Understanding Process Flow in S/4HANA

Now that you have read the first two blogs in this Group Reporting series, we encourage you to take a look at our third and final blog, Understanding Group Reporting Process Flow in S/4HANA.

Tags:

SAPApr 7, 2021

-1.png)