Mastering Document Splitting in SAP Central Finance: Essential Insights for Financial Precision

What IS Document Splitting in Central Finance?

For Central Finance (CFIN), activating document splitting is essential as it generates complete SAP financial accounting statements in real-time for various dimensions, including:

- Segments

- Profit Centers,

- Business Areas and

- Customer-defined Dimensions

This capability provides customers, consultants, and end-users greater reporting granularity and flexibility, aligning with evolving business needs and regulatory requirements.

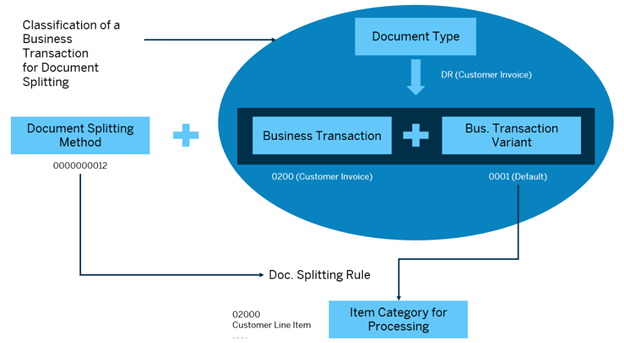

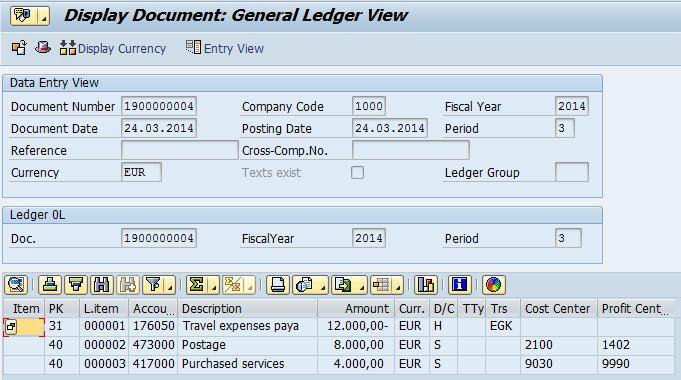

The foundation of document splitting logic lies in the distinctive pairing of document types with business transactions, alongside the association of accounts with item categories. These item categories define document splitting rules, influencing the system's behavior in splitting document items based on the nature of the transaction. Each document-splitting rule is linked to a specific document-splitting method.

Depending on the source systems settings, there are two main scenarios from a CFIN perspective.

Scenario One: Source System with New G/L

If the source system is on New General Ledger (New G/L) with document-splitting enabled, the splitting characteristics in the source systems might differ from or align with those in the CFIN system. In such cases, the CFIN system utilizes document-splitting rules to repost financial documents accurately.

However, it's important to note that scenarios where the source system uses different document splitting configurations are not offered as out-of-the-box functionality. In release 1909, SAP introduced configuration consistency checks to verify the alignment of document splitting activation between the source system and the Central Finance system. Any issues identified in document splitting can be addressed through custom development or configuration changes in Central Finance to ensure adherence to the source document splitting rules.

The consistency checks encompass various aspects, including the classification of G/L accounts for document splitting, classification for document types, and document splitting characteristics for General Ledger Accounting. These checks ensure that document splitting settings are consistent across source and target systems, maintaining data integrity and accuracy throughout financial reporting.

To further assist customers, SAP provides a simulation tool within the SAP Application Interface Framework (AIF) to analyze document splitting-related postings in the target system. This tool allows users to select a specific document and execute a simulation of document splitting, enabling proactive identification and resolution of any issues or discrepancies.

When configuration settings for document splitting align between source and target systems, the document splitting information is replicated both during the initial load of documents and open items and in ongoing replication processes.

Scenario Two: System with Inactive Document Splitting

In cases where the source system does not have Document Splitting active, a scenario supported as of SAP S/4HANA 2020, a customizing activity in Central Finance is necessary to transfer the document splitting settings from Central Finance to the source system while document splitting remains inactive in the source. If document splitting is configured in the Central Finance system, the document splitting logic is applied during the re-posting of documents. However, the effectiveness of this scenario depends on customer-specific side-conditions.

Several issues may require custom development to resolve. These include:

- Initial balances and open items transferred by Central Finance do not include document-splitting characteristics.

- Document splitting rules are based on the document type used for a specific business transaction. If a document in the source system combines multiple business transactions in a single posting, the splitter may not find an appropriate rule to apply, resulting in an unsuccessful posting in Central Finance.

- Mandatory splitting characteristics, such as profit centers, must be supplied in the posting. If not used in the source system posting, the posting will fail. Using a constant (dummy) in the splitter configuration can be considered a workaround.

- For follow-up costs or closing activities in FI, splitting characteristics are derived by clearing or closing transactions in the source system. Differences in splitting configuration may result in missing characteristics and denied postings.

- Cross-company transactions between company codes with active and inactive document splitting will result in errors in Central Finance.

Recommendations

Implementing document splitting requires a thorough examination of business operations, identification of pertinent business transactions, and often, customization of document types. To effectively deploy Document Splitting in CFIN, several factors merit attention:

- Understand the customer's reporting requirements for Profit Centers and Segments within the CFIN system.

- Determine how the CFIN system will derive Profit Centers and Segments, particularly for Balance Sheet and Revenue G/L accounts.

- Identify any custom fields incorporated into the Coding block that necessitate inclusion as document-splitting characteristics within the CFIN system.

- Establish the approach for utilizing document types in the CFIN system, including whether all source document types will map to a single document type (n:1) or if each source document type will correspond to specific target document types in CFIN (1:1).

Lessons Learned:

- The activation of document splitting in the CFIN System initiates logic during document reposting, which is contingent upon customer-specific conditions.

- For non-SAP and SAP source systems lacking Document Splitting, multiple tasks are required to ensure consistent financial document replication to a CFIN target system with active Document Splitting.

- The subledger of asset accounting is not transferred to CFIN, necessitating consideration of item category assignment in the splitting logic for balance sheet accounts.

- Document splitting closely aligns with document types, typically representing distinct business transactions.

- Provision of comprehensive Document Splitting education sessions to customers is imperative for informed decision-making.

- The handling of open item loading differs from real-time replication, requiring a custom solution or assignment of a dummy/constant characteristic.

- Document splitting design in CFIN should mirror source system processes, potentially necessitating the creation of custom transactions and variants.

- Custom solutions may be necessary to populate document-splitting characteristics for balances and open items during the initial load if the source system lacks document-splitting.

- In Classic GL systems, a thorough review of document type usage in relation to Central Finance document splitting settings is crucial.

- Ensuring all company codes involved in cross-company code transactions are part of the same initial load group prevents document-splitting issues.

If you're ready to master SAP Central Finance, we invite you to Discover a Better Way to Learn SAP Now with Michael Management.

Tags:

SAPMay 6, 2024

-1.png)

.jpg)