Nowadays there is a tremendous interest in S/4 HANA, especially from current SAP customers. It’s about what, why, and how to go to S/4HANA. This motivated me to start writing a series of blogs on the subject matter.

In this part 1 of the blog I will explain the what and the why of S/4HANA. In part 2 How will be explained further.

Let’s start from the beginning by knowing the product. The What. In the title of this post, I say ‘Finance in S/4HANA’ and not ‘S/4HANA Finance’. That has a reason which you will find out below. This post expects some entry-level knowledge about S/4HANA and the HANA technology in general. I will dive into the different S/4HANA product versions and the Finance specific topics.

The What… Let’s know the product

In 2014 SAP introduced simple innovations starting in the area of Finance. The new product was initially named ‘Simple Finance’ and at that time there were already rumors about ‘Simple Logistics’. The Simple naming convention lasted until the release of Simple Finance 2.0. In 2015 SAP announced that the name Simple Finance will be changed to S/4HANA Finance. By doing this, SAP introduced heterogeneous naming across different product lines. Simultaneously it created a lot of confusion with all the different release numbers.

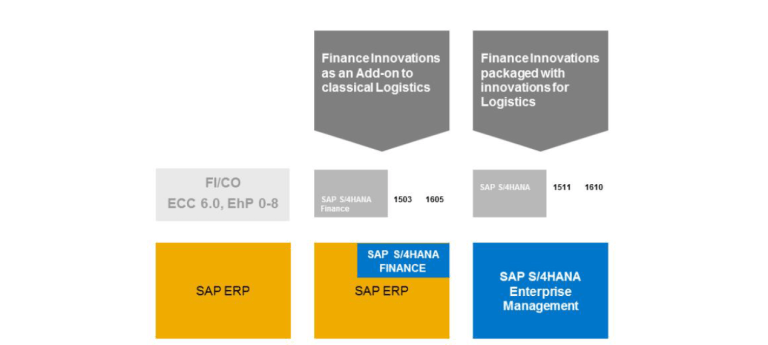

Let me try to help you understand the differences. As you can see in the figure below, S/4HANA Finance is a different product that S/4HANA (Enterprise Management).

S/4HANA Product Versions

S/4HANA Finance includes only the finance innovations (replacement of classis FiCo) on to the already existing system. So everything in logistics will remain as it is. You can imagine that the migration effort to this product is lower than directly going to S/4 HANA. More about this in the ‘How’ topic.

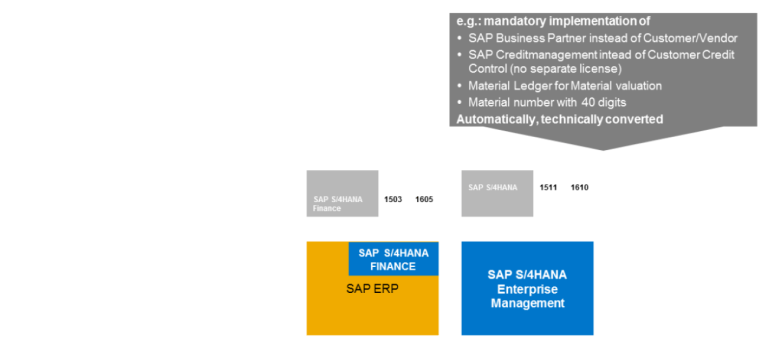

In S/4HANA 1610, SAP has included all the available functionality of the latest release of S/4HANA Finance 1605. This means that in terms of Finance S/4HANA 1610 and S/4HANA Finance 1605 are in sync.

Except for some minor differences which are listed below. This makes things a bit easier to understand later on :).

S/4HANA Enterprise Management and Finance deltas

The Why… Key differences and innovations in the area of Finance in S/4HANA 1610

Now we have to understand the product. Let’s look at the benefits of S/4HANA for our organization. In this topic, I will hit the key differences compared to classic FiCo in R3.

To make the list comprehensive I will also mention some features which were already included in Simple Finance 1.0 back in 2014.

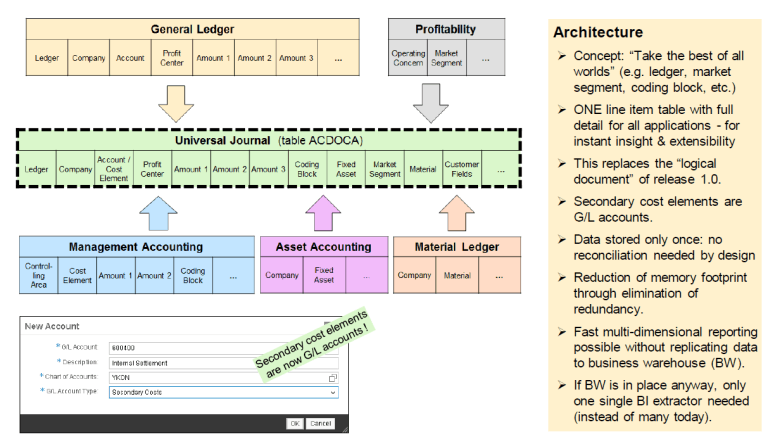

One Single Source of truth and all accounts become GL accounts

All actual line items will be stored in the new table ACDOCA. The will be no redundant, aggregate or total tables anymore. All dimensions of GL, CO, COPA, AA, and ML will be in ACDOCA.

In the ACDOCA we have multidemsional GL, parallel ledgers, parallel currencies, 999,999 line items, and custom-defined fields. The challenges of gathering combined content of several tables to represents the truth and reconcile the different levels of detail stored in the different components/tables of SAP (e.g. CO= much detail, Fi= less detail) is now something of the past.

S/4HANA One Single Source of Truth

S/4HANA One Single Source of Truth

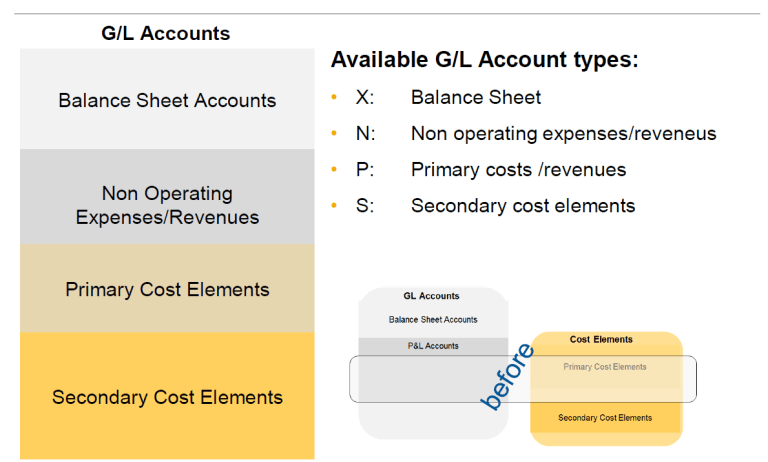

The reason for the merge of secondary and primary cost elements is the fact that all actual line items will now be stored in one single table. The ACDOCA. This also applies to purely (internal) CO postings. You should not include these secondary accounts in your P&L.

S/4HANA GL account Cost Element

Parallel currencies and parallel valuation

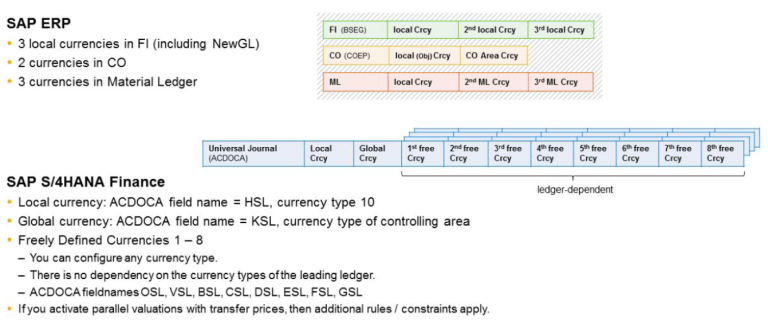

In S/4HANA 1610 we can now have up to 10 parallel currencies per ledger. Real-time conversion for all currency types is possible, Zero balance per document is guaranteed for each currency and CO-area currency is now calculated for all accounts (also non cost element).

S/4HANA Additional Currencies

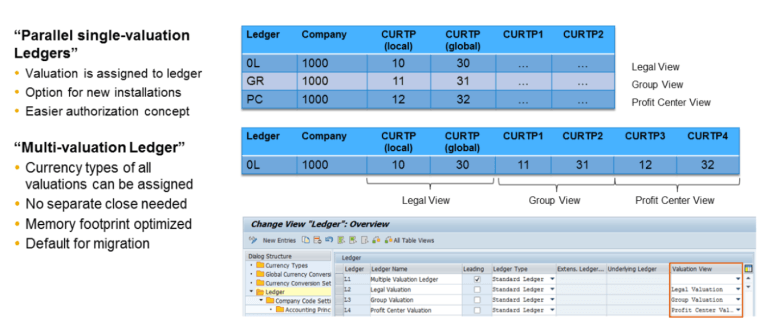

Parallel valuation functionality is significantly enhanced in S/4HANA 1610. SAP now provides two options to store multiple valuations:

- Parallel valuation updated in parallel single-valuation ledger

- Separate ledger for each valuation

- Transparent separation of posting and reporting based on different regulations

- Parallel valuation updated in multi-valuation ledger

- Separate amount columns in the same ledger

- Reduce memory footprint

- Reduce effort and time for closing

See an example of the 2 methods below.

S/4HANA Parallel Valuation

Profitability Analysis in S/4HANA 1610

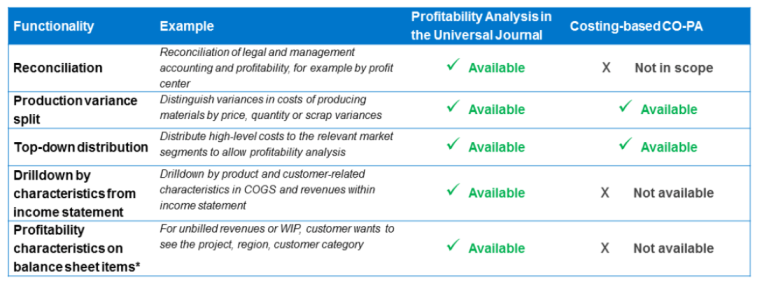

With S/4HANA SAP focuses on the enhancement and integration of Account-based COPA. This is the preferred type of Profitability Analysis. Costing Based profitability analysis is still available and can be used in parallel, but there will be no integration with the Universal Journal (ACDOCA table).

Below you will find the list of enhancements on Account-Based profitability analysis. Critical gaps in the past are closed.

- Split of Cost of Goods Sold on multiple accounts based on cost component split. This is done during posting of the Goods issue.

- Split of production variances on multiple accounts. This is done at order settlement.

- 3 new quantity fields provided in the line items and a BAdI for the conversion of the logistical quantities to common quantities in Finance.

- Real-Time derivation of market segment information from cost postings (Cost Center, order, etc.)

Summary of the enhancement:

S/4HANA Profitability Analysis

Unfortunately, there are still some limitations that are on the future roadmap. Current limitations of Account-Based profitability analysis:

- Sales conditions which are not posting to GL (statistical) are not supported

- Realignment of characteristics that are changed after posting are partially supported. Not for all characteristics!

- Creation of sales order generates expected revenue, COGS, etc. in profitability analysis is not supported.

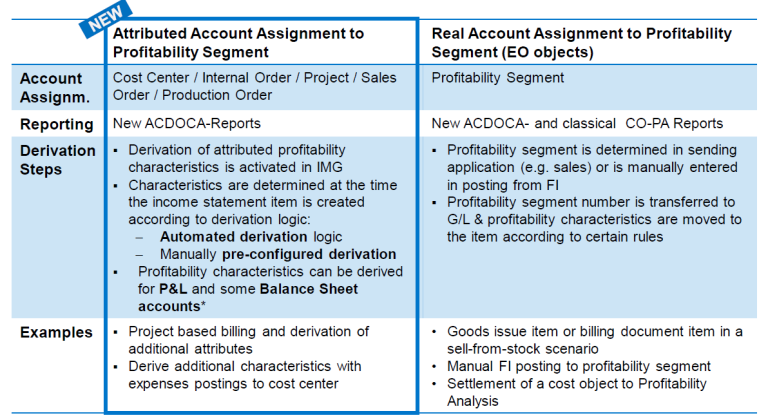

Attributed Profitability Segments

In my opinion, this is one of the greatest enhancements in Profitability Analysis. I was always thinking about why this was not possible in SAP and now it is here! With a couple of additional configuration steps the ‘Attributed PA segment’ can be activated.

S/4HANA Attributed Profitability Segment

Another good example is when you have a debit memo request in a Time & Material Service order which has a settlement rule for settlement to COPA. The debit memo request will have an account assignment to the service order and no profitability segment. That means that you do not have the profitability segment information until the service order is settled to COPA. With this new functionality, you can have the real account assignment to the service order and an attributed assignment to a profitability segment. Great stuff!

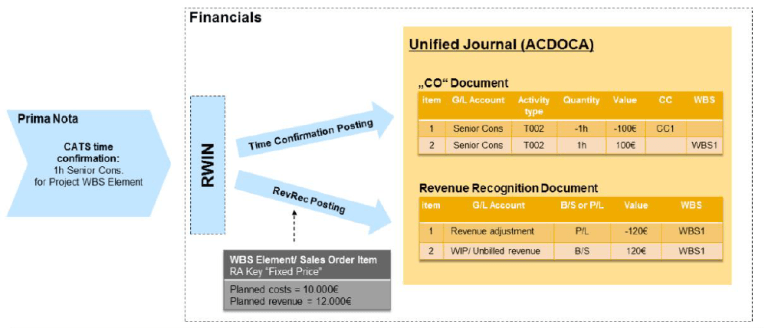

Event-based revenue recognition

The revenue recognition process is now fully integrated with the Universal Journal. There is no separate storage for Revenue Recognition data anymore.

Cost and revenues are recognized as they occur. The entry of the source document will generate two postings. An entry for the initial costs and revenue and an entry for the revenue recognition posting.

S/4HANA event-based Revenue Recognition

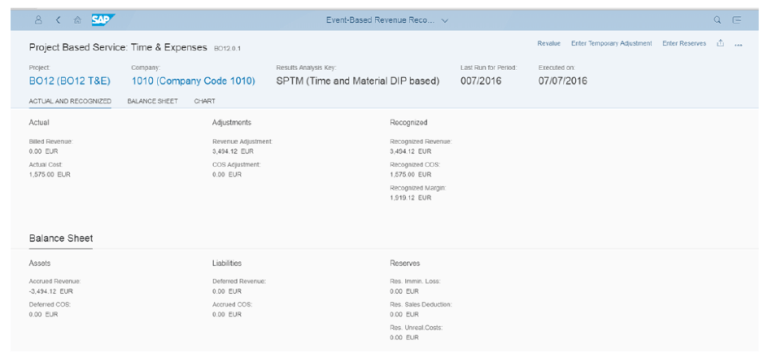

There is even a new app ‘Event-based revenue recognition’ for monitoring of revenue recognition postings and manual adjustments.

S/4HANA Event Based Revenue Recognition app

Bank Account Management (lite)

In the ‘old’ setup there were house banks and bank accounts in SAP. In S/4HANA basic functions of the Bank Account Management functionality of Cash Management is brought in to the core. This is called Bank Account Management Lite.

The main new features and differences compared to the old house bank and bank account setup are the following:

- Group-wised account management

- Signatory

- Overdraft Limit

- Opening and Closing with approval process

- Easily maintain bank accounts

To highlight the latest point. Bank accounts are now part of master data and can be maintained by users through a dedicated Web Dynpro or Fiori application. The house banks itself are still created in customizing. Transaction Fi12 is obsolete and the new transaction Fi12_hbank is introduced for this purpose.

So the process of creating the house bank and the house bank account are separated and executed in two different places.

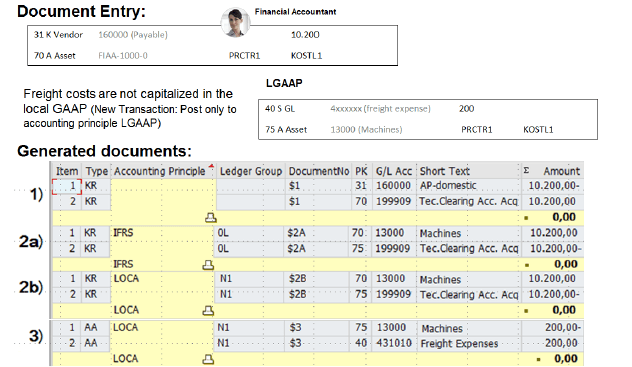

New Asset Accounting

Migrating to New Asset Accounting is a pre-requisite for migration to S/4HANA (Finance). The reason and motivation behind New Asset Accounting is:

- Reconciliation between GL and AA ensured

- Transparent assignment of depreciation area to accounting principle

- Simplified chart of depreciation: only 1 CoD per valuation

- No delta depreciation areas

- Asset balance in real-time (APC posting run not needed)

- Plan values in real-time

- No data redundancy

Usage of the New Depreciation Calculation Engine is mandatory and the tables ANEA, ANEP, ANEK, ANLC, and ANLP are not updated anymore in New Asset Accounting.

An example of the new posting logic during integrated asset acquisition with two ledgers with two different accounting principles:

S/4HANA New Asset Accounting

As you can see a new ‘technical clearing account’ is used to post accounting principle specific documents. The balance of the technical clearing account is zero.

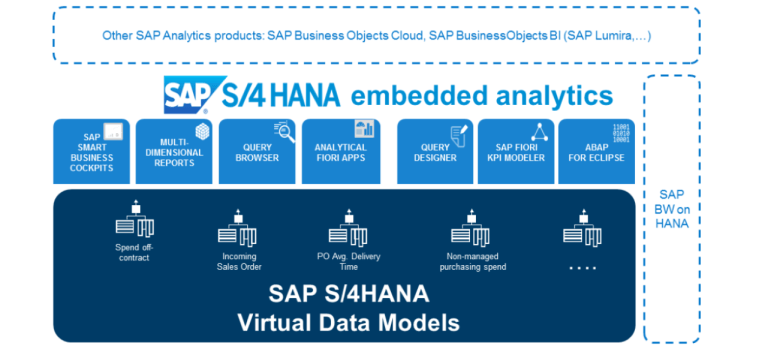

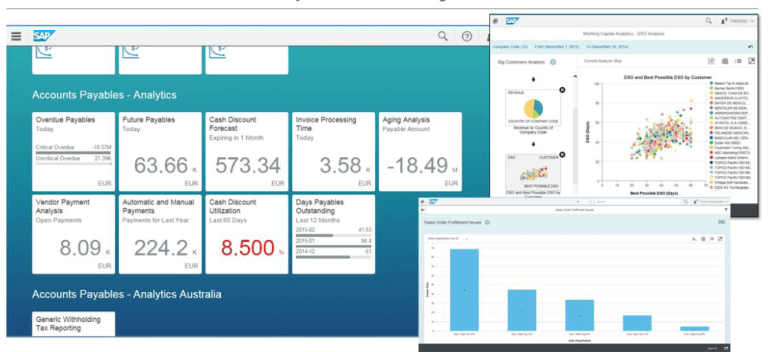

Embedded Analytics and Reporting

SAP blends transactions and analytics in one system allowing operational reporting on live transactional data.

I can talk hours about reporting in S/4HANA. With the new data structure (e.g. ACDOCA), all the pre-delivered Virtual Data Models (VDM’s), the performance of HANA and the modern and state of the art reporting tools/interfaces, there are so many new possibilities.

The concept of embedded analytics in S/4HANA is to provide pre-defined models across the entire suite in which the business logic is embedded. So the provided data models are delivering contextual information rather than raw data.

S/4HANA Embedded Analytics architecture

In a nutshell, I can say that the following reporting tools are mostly used at my customers where I did S/4HANA implementations:

- Fiori-reporting

- Analysis for Office

- SAP Lumira

S/4HANA Reporting Tools

Each tool has its own purpose of course. I can say that without of the box analytical Fiori apps and the KPI Modeler in SAP Smart Business together with the Analytical Path Framework already provides a lot of content and satisfies a lot of customers.

Some examples of Smart Business cockpit and the Analytical Path Framework apps.

S/4HANA Out of the Box Reporting with Fiori

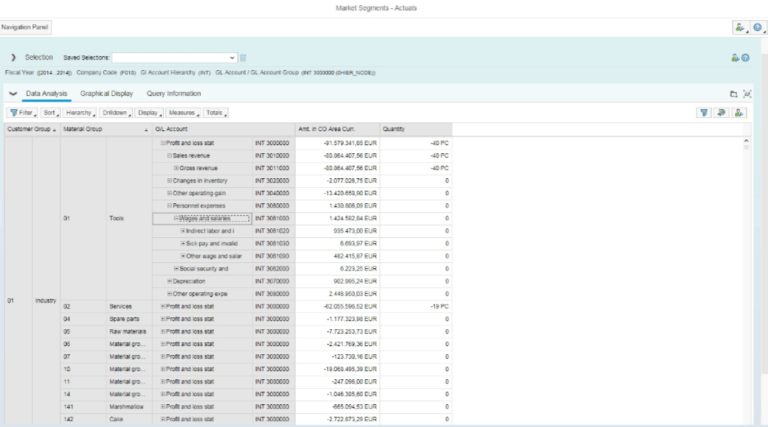

Next to these types of apps, SAP provided multi-dimensional reporting apps. For example, the Market Segment Actuals app in which I can report on my P&L with in addition my Profitability Analysis characteristics.

S/4HANA Market Segment Actuals App

For more flexibility, the products from the BO suite (additional license) Analysis for Office and Lumira can be used. This is worth another separate blog.

After reading this blog I hope you have gained a good understanding of the S/4 product and the key differences and innovations in the area of Finance. Part 2 will explain How. With the different migration scenarios and deployment possibilities.

Tags:

SAPSep 18, 2017

-1.png)