Whether you’re a CIO at an SAP Client Company, SAP Project Manager, or SAP Consultant, you will, sooner rather than later, need to build, review, understand or update an SAP Business Case.

Whether you’re a CIO at an SAP Client Company, SAP Project Manager, or SAP Consultant, you will, sooner rather than later, need to build, review, understand or update an SAP Business Case.

If you’re an SAP Activate Certified Project Manager, you probably already know that the very first item in any flavor of an SAP HANA implementation is the business case. If you’ve ran as many different types of SAP implementations as I have, you’ll also know that there is often no business case.

This is one of the biggest indicators of future project failure and one of the most critical project elements to get right.

The Different Business Case Flavors

In my experience, business cases come down to two broad general types:

- Business cases for Greenfield Implementations

- Business cases for specific SAP Sub-Projects

- Sub-projects come in many flavors

- Rolling out additional functionality, like SAP Transportation Management

- Upgrading to SAP S/4 HANA

- Carve-Outs using the SAP SLO tool and team (Brownfield)

- HANA migrations

- Divestitures

- Sub-projects come in many flavors

Though there are certainly other scenarios, I mention these to give you an idea of the various implementation scenarios you’ll likely encounter out in the wild. The process for building a solid business case is roughly the same for each. The complexity of building a business case in each of these scenarios can vary wildly.

The SAP Approach

SAP, realizing long ago that to compete and win, developed an approach to business case development that was known as the Customer Engagement Lifecycle, or CEL for short.

The ASAP implementation methodology could be considered a subset of the CEL and developing a value case was part and parcel of the methodology. Now that the implementation methodology has evolved to become the SAP Activate methodology, SAP has also developed a set of updated tools to help in the development of business cases that supports the Discover Phase of the Sales Cycle, Implementation, and then the Continuous Business Improvement cycle of SAP.

In addition to tools, they have developed an internal organizational capability to perform Value Engineering and Business Transformation Consulting. This internal capability is meant to work collaboratively with external partners as well as support the complete SAP lifecycle.

Consultative Selling Approach

All of these tools and organizational elements form part of the methodology used to build a business case. The methodology is very much aligned with the precepts and concepts of the book, “Consultative Selling, The HANAN Formula for High-Margin Sales at High Levels”, first released in 1970.

If you get a chance, give it a read, and don’t skim through it. Let me try to summarize the process it recommends then show you how to do it on your own and provide you with a tool to get you started.

Benchmarking

Though a far more complex and controversial subject than you might expect, in the context of building your building case, having your own benchmarks or norms is a critical first step.

That’s why SAP has the SAP VLM or SAP Value Lifecycle Manager tool. It’s a tool for you to compare your own company processes against other SAP customer benchmarks.

It also provides an estimate of the likely improvement to any particular KPI, and gives a range of Pessimistic, Optimistic and Likely Values, and provides a likely dollar value for each of these.

Keep in mind that these are self-reported numbers. It can and will take considerable effort to complete your benchmarking exercise using your own numbers.

The challenge is oftentimes your KPIs (Key Performance Indicators) and the ones you find in here may not mean the same thing. If you’re an external consultancy and you’re working on a greenfield implementation business case, I recommend you make friends with the Accounting and Finance department of your client, as they are usually the ones with the best data, but you will also have to spend time with LOB (Line of Business) owners to truly understand the numbers.

If you’re looking to benchmark a particular business area or even single KPI, you can use this same tool. You can also export the results and if you have it, upload it to your SAP system for use in PPM for subsequent monitoring to see whether your expected business case results were achieved. This can be complex to set up but is doable and should form a part of your overall implementation plan.

You should also be aware that very often, a customer will push back heavily on these numbers. There’s a lot of reasons for this, some legitimate and others, not so much. You’re on the right track if you’re arguing on whether the savings is ‘only’ going to amount $20 million annually versus your estimate of $30 million while your estimated implementation cost is $million.

From Benchmarks to Business Case

Now that you know how you’re performing, KPI by KPI, it’s time to build your business case. For the MBA crowd, you will recognize that the following isn’t specific to SAP or even IT. It’s just how you convert your numbers into the language the ‘C’ Suite understands.

Your project will consist of several buckets of ‘investment’ money plus an expected eventual ‘Return’. It will also be competing against many other projects a company could spend its limited funds on. In order to provide a common project evaluation method, all your future ‘dollars’ will need to be converted back into today’s dollars, typically using NPV or Net Present Value. Your project NPV will also need to surpass the company's Hurdle rate.

Dollars Today are Worth More Than Dollars Tomorrow

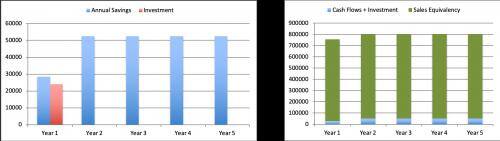

NPV is a fairly simple concept – a dollar today is worth more than a dollar in the future. Fortunately, Excel has an NPV function built-in and makes it easy to develop an NPV and IRR (Internal Rate of Return) calculation. As long as your project’s NPV at least equals your clients' internal Hurdle rate (The hurdle rate is the minimum rate of return on an investment that will offset its costs), your project has a shot at getting funded. I’ve included a chart from a small example project so that you have an idea of what the final output of these types of exercises look like.

Sales Equivalency

In both the ‘Consultative Selling’ book and in the ‘Indispensable by Monday’ book by Larry Myler, released in 2010, the concept of Sales Equivalency is used, even though they were written decades apart.

What is Sales Equivalency?

It’s the amount of Sales Revenue a company would have to generate to achieve the same profit as the savings a project will generate at a particular profit margin. For example, for a company earning a 1% net profit margin, to achieve $25,000 in profit, it would need to sell $2,500,000 worth of product or service.

Cost Reduction Focus vs Revenue Improvement

SAP projects are usually heavily focused on the ‘cost reduction’ benefits they bring, which means your business case needs to convert those savings into Sales Equivalents. However, SAP can also provide a tremendous boost to sales! These boosts to sales can come from many points along the value chain, i.e., fewer stockouts, better customer service, better equipment maintenance resulting in less downtime, and many others. With more than 1,300 solutions on their price list, and much more available from partners, there’s usually a solution available for whatever pain your customer is feeling.

Business Case Process Development Summary

- Identify KPIs

- Perform Benchmarking Exercise Using SAP VLM (or other Benchmark databases)

- Estimate Improvement in Each KPIs

- Project Cash-Flows at Least Five Years Into the Future

- Convert into Dollar Value

- Bring ALL Future Dollar Values Back to the Present Using NPV

- Ensure NPV Exceeds Company Hurdle Rate

Business Case Tool Using Sales Equivalency

I’ve developed my own Excel Business Case Development tool. You will still need to do the heavy lifting of Benchmarking, KPI identification, and Cash Flow estimations but this tool wraps it up for you and provides neatly summarized data for presentation to the C-Suite and is suitable for your SAP HANA Activate Project Implementation plan.

Tags:

SAPAug 24, 2020

-1.png)